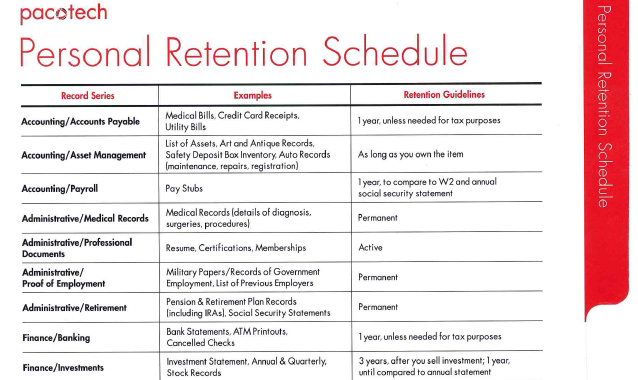

This handy tool will help you maintain your retention guidelines for all those bits of information you may be holding onto that you can get rid of! If you are interested in receiving one or have more questions, feel free to visit the website or contact us via email, and we will provide one today!